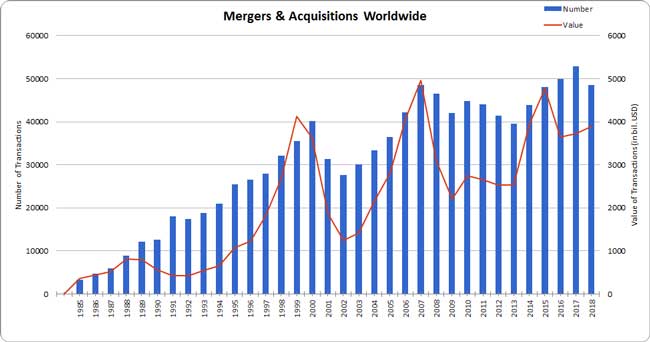

The day after biotech firm Bristol-Myers Squibb (BMS) announced a proposed acquisition of pharma company Celgene, news headlines focused on the particulars of the deal, and the potential for the first big acquisition of 2019 to be a catalyst for biotech takeovers in the coming year. The BMS news certainly started the new year off with a bang, continuing a trend from 2018 in which merger and acquisition (M&A) activity was high, with worldwide deals valued at nearly $4 trillion according to the Institute for Mergers, Acquisitions and Alliances (IMAA).

Figure 1: Mergers and Acquisitions Worldwide

Source: The Institute for Mergers, Acquisitions, and Alliances (IMAA); retrieved from https://imaa-institute.org/mergers-and-acquisitions-statistics/.

Inevitably, as M&A deals are conceived, negotiated, and closed, interested parties focus primarily on the business aspects of the agreement and the industry implications. That’s natural. But it’s also true that there are secondary and tertiary aspects of M&A activity that, while perhaps not the primary focus, can often make or break a deal and don’t often get the due diligence or attention they deserve. For instance, serious issues can crop up when acquiring a variety of unfamiliar retirement and health insurance programs. Companies typically like to delay due diligence of employee benefits to maintain the confidentiality of the impending deal and because employee benefits may be perceived as being less material to the decision about whether to proceed or not. Unfortunately, this level of discretion can be costly, as employee benefit programs can deeply affect a potential deal, sometimes to the surprise of the acquiring company.

What can go wrong

Here are a few examples of problems that may not be apparent without in-depth scrutiny:

1. The target company has a pension plan whose value has recently been certified by an independent actuary. After the deal, you discover that the existing valuation did not accurately reflect the liquidation cost of the plan. Thus, the acquiring company has accepted additional cost or risk it may not have fully quantified in the purchase price.

2. To build morale in the new combined workforce, you’ve been planning to extend your generous 401(k) match to new employees. However, subsequent nondiscrimination testing of the combined populations reveals that the plan will not pass testing, requiring unpopular remediation measures like refunds.

3. In contrast to the previous example, you have decided to equalize benefits across your different employee populations over time. As a result, prior to harmonization, two people working side by side could have health insurance options with inherently different value. This dynamic presents a challenge for management to choose a common benefit level that meets the HR objectives of the combined company at their target cost, or rationalize benefits with inherently different value to a combined workforce.

A better way to harmonize employee benefits

The best way to reconcile two different employee benefit programs during a merger or acquisition is to begin the due diligence process in advance of the impending deal, armed with the proper expertise. Early due diligence would allow you to spot serious problems quickly and either mitigate the risk in advance of the deal (for example, by reflecting pension underfunding in the price of the deal), or potentially change the terms of the deal (for example, by not transferring legacy pension liabilities). Identifying less dire issues early – inefficiencies, redundancies, and potential regulatory problems – allows you to build corrective measures or potential ongoing cost savings into the structure of the deal. Starting early with the proper expertise and a “benefits timeline” can help newly merged companies begin operating on Day 1 with all benefits programs running according to plan. That’s important for employees who may be adjusting to major changes in the way they work.

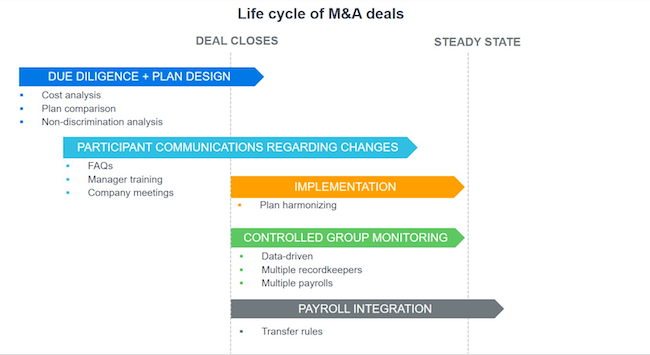

The M&A benefits timeline

The benefits timeline begins when business leaders have made critical decisions about the character of the deal and how it will affect the workforce. Is it a stock deal? Or is it an asset deal that targets particular business units or locations? In other words, how will the deal be structured? How will employees of both companies be treated, especially the target company? Employee compensation and benefits represent the lion's share of the cost of running many businesses.

Once the size and composition of the new, combined workforce is determined, it’s a matter of identifying the benefits strategy that will best support the employer’s HR and business objectives. Specialized expertise can help create the optimal design from the many different types of benefits that are available. Other key dates include: the first public announcement of the deal; closing the deal; and the conclusion of the Benefits Timeline, when the benefits programs are fully harmonized and have reached a “steady state.”

Figure 2: Managing Employee Benefits During M&A

Step 1: Due diligence and plan design

The due diligence and plan design process begins with management asking questions: How much will it cost to harmonize these different plans? What are the key workforce risks from an operational standpoint? Do the current employee benefit programs meet the future merged business needs? What actions need to be taken to ensure Day 1 readiness? What are the latest trends in defined contribution (DC) retirement plan design? How will we treat participants in our non-qualified plans? What about our stock plans? How do we want to share retirement risk with our combined workforce?

The true answers don’t appear until later, after in-depth analysis of costs and objectives. But they are helpful in bringing out management’s top-of-mind concerns. The full picture emerges via systematic consultations with HR directors, chief financial officers, and other business leaders in the company.

A detailed plan comparison lays out all of the plans and their features as a visual aid. For example, DC plans have more differences than many people realize. Vesting policy, types of rollovers allowed, match formula, deferral percentages, availability of loans, hardship withdrawals, and the quality and breadth of choice of investment options are all variables that affect the value of the plan to employees. Compliance, employer cost, administrative complexity, tax incentives, and suitability to the workforce can provide a framework for plan sponsors to pick the features they want to include in the harmonized plan.

Health and welfare plans are similar and are dealt with in a parallel process.

Pension plans, if included, require specialized treatment. Due diligence of assets, liabilities, the funded ratio, fiduciary compliance, and other key metrics is essential. In the current environment, the trend is toward terminating or otherwise “de-risking” pensions to insulate the plan sponsor from market volatility.

The most successful employee benefit design involves understanding the trade-offs associated with each decision affecting retirement, health insurance, and other benefit programs. For example, if compromise on retirement benefits leads to cost savings, then health insurance compromise could leverage savings from retirement benefits to increase value to employees.

Step 2: Participant communications

In the benefits timeline, “participant communications” begin before the deal closes for one important reason: Employees should learn about the merger from their own company. This means that communication best practices include a notice to employees describing the forthcoming combination of businesses and the likely impact it will have on them, including the status of benefit programs. In most cases, the timing of this letter would coincide with the formal public announcement of the deal. If employee benefits are still under discussion, having the process started will allow companies to set clear expectations on when more information will be available.

Other participant communications materials can be put into production as soon as the details of the benefits programs are finalized. These include enrollment books, required notices regarding plan features, investment primers, descriptions of health insurance options, FAQs, and videos, plus manager training and preparation for enrollment meetings.

Step 3: Controlled group monitoring

Controlled group monitoring refers to a process for ensuring that individuals from the two employee populations follow the rules for the correct benefits program—until the companies reach a “steady state”—that is, the point at which the entities’ employee benefit programs are finalized.

It’s important to point out that “steady state” does not always—or even often—equate to one consolidated benefits plan for the newly merged entities. This can create complications because managers are generally working to instill a “one company” work ethic that promotes a cross-pollination of ideas and people. However, if people start moving across the company, it’s the company’s responsibility to keep them from making mistakes like taking impermissible distributions. Inadvertent mistakes can result in penalties to either the plan sponsor or the participant.

Merging key vendors such as recordkeepers and payroll providers has the potential to make this process trickier if the company has to aggregate data from many sources. While these functions may sound mundane, getting different systems to sync data properly can be a headache. Starting early with providers that have a good track record with integrating these key functions will lead to success. As a bonus, it can also provide an opportunity to step back and work with providers to further streamline the administration of benefits.

Step 4: Implementation

Implementation refers to all of the activity taking place between the closing date and the time when all benefit programs are finalized to the satisfaction of the plan sponsor (i.e. “steady state”). This can involve a multiyear period as some of the activities, particularly those involving the elimination of a plan, can take months or years to complete.

DB examples

Although defined benefit (DB) pension plans are a prized benefit for employees, the associated market risk over the last decade has discouraged many companies from continuing to offer them. In an M&A situation, it would certainly be a daunting proposition for company with no DB experience to acquire a company with a mature pension plan. In addition to the volatility of pension expense year over year, issues of governance and fiduciary responsibility require considerable attention and expertise.

The decision to terminate a pension plan is typically more complicated and expensive than may be initially understood. The simplest option, freezing a plan, eliminates future accruals. But this does not end the plan sponsor’s responsibility to continue funding the program for existing beneficiaries. Also, the sponsor will often evaluate options for making up for losses in future DB accruals through a DC arrangement.

DC examples

In theory, the combination of two companies with existing DC plans would result in the consolidation of the two plans with as little delay as possible. That way, the acquiring company avoids the need for two plan documents, two audits, two 5500 annual reports, two data feeds, and two recordkeepers. There are three basic methods to harmonize DC programs, assuming that each company has its own existing DC plan: (1) immediate termination, (2) maintain separate plans, and (3) merge plans.

All sponsors have a window (12 months after the end of the plan year in which the transaction happens) to determine a course of action before nondiscrimination testing would require them to potentially change the plan or address testing failures.

As a result, most merged companies elect to keep the legacy plans separate for a year or two before bringing them together. During the transition period, there’s typically quite a bit of manual intervention and monitoring to track vesting, distributions, hardships, and loans.

End goal: Steady state

Most companies strive to reach “steady state” as soon as reasonably possible. This is the point when companies have finished harmonizing their benefit programs to their satisfaction, no compliance issues remain, payroll is fully implemented, and plan design is resolved.

Getting to this point takes advance planning and expertise. As part of the M&A process, it’s important for business leaders to recognize that the health of their new company stands to benefit when their employees are not burdened with ongoing turbulence regarding their compensation and benefits structure. A successful M&A process results in an employee benefits program that achieves corporate goals and establishes the right incentives for employees.

On a related note, as previously stated, the first large acquisition news of 2019 is the Bristol-Myers Squibb (BMS) and Celgene proposed transaction. Prior to BMS announcing their acquisition of Celgene, they moved forward with plans to terminate their last legacy defined benefit plan.1 The BMS plan termination completes the defined benefit lifecycle for them (i.e. freeze, increase funded level to 100% and terminate) and sets the stage for BMS and Celgene to move forward with defined contribution plans as their only retirement plan focus as a combined entity. While both companies offer defined contribution plans, they have varying company match levels and unique features, as well as key similarities. Only time will reveal what their due diligence into their employee benefit offering determines and when they will reach their “steady state”.

1Source: Bristol-Myers Squibb to terminate $3.8 billion U.S. pension plan https://www.pionline.com/article/20181205/ONLINE/181209952/bristol-myers-squibb-to-terminate-38-billion-us-pension-plan